Fintech SEO Agency Strategies: Dominating SEO for Fintech & Services

An intro to Fintech SEO

The industry is booming, and the need for specialized SEO for Fintech has never been greater. In 2026, providers of SEO Fintech Services must focus on leveraging semantic search, establishing authority, and navigating strict compliance regulations. At Calvin Agency, we offer expert insights into optimizing your SEO efforts to stay ahead of legacy banks and agile startups.

Simply put, Fintech (Financial Technology) encompasses any innovation that streamlines financial services. While Martech (Marketing Tech) overlaps, Fintech requires a specific focus on trust signals and data security.

Simply put, Fintech (Financial Technology) encompasses any innovation that streamlines financial services. While Martech (Marketing Tech) overlaps, Fintech requires a specific focus on trust signals and data security.

Key Takeaways

| Trend | Details |

|---|---|

| Strategy Focus | Entity SEO & Topic Clusters |

| Average Cost-Per-Click (CPC) | High (£29+) - Hybrid Strategy Required |

| Technical SEO | Core Web Vitals, E-E-A-T & Bank-Grade Security |

| AI and Machine Learning | Human-in-the-Loop (HITL) Content & Compliance |

| Project Duration | 6-8 Weeks Setup (Ongoing Execution) |

| Demand Increase | 20% YoY increase projected for 2026 |

Key Trends in Fintech SEO for 2026

Fintech SEO agencies are shifting toward semantic strategies and technical rigor to enhance visibility, drive organic traffic, and maintain trust in a hyper-competitive market. Here are the key trends that will shape fintech SEO in 2026:

From Keywords to Entities

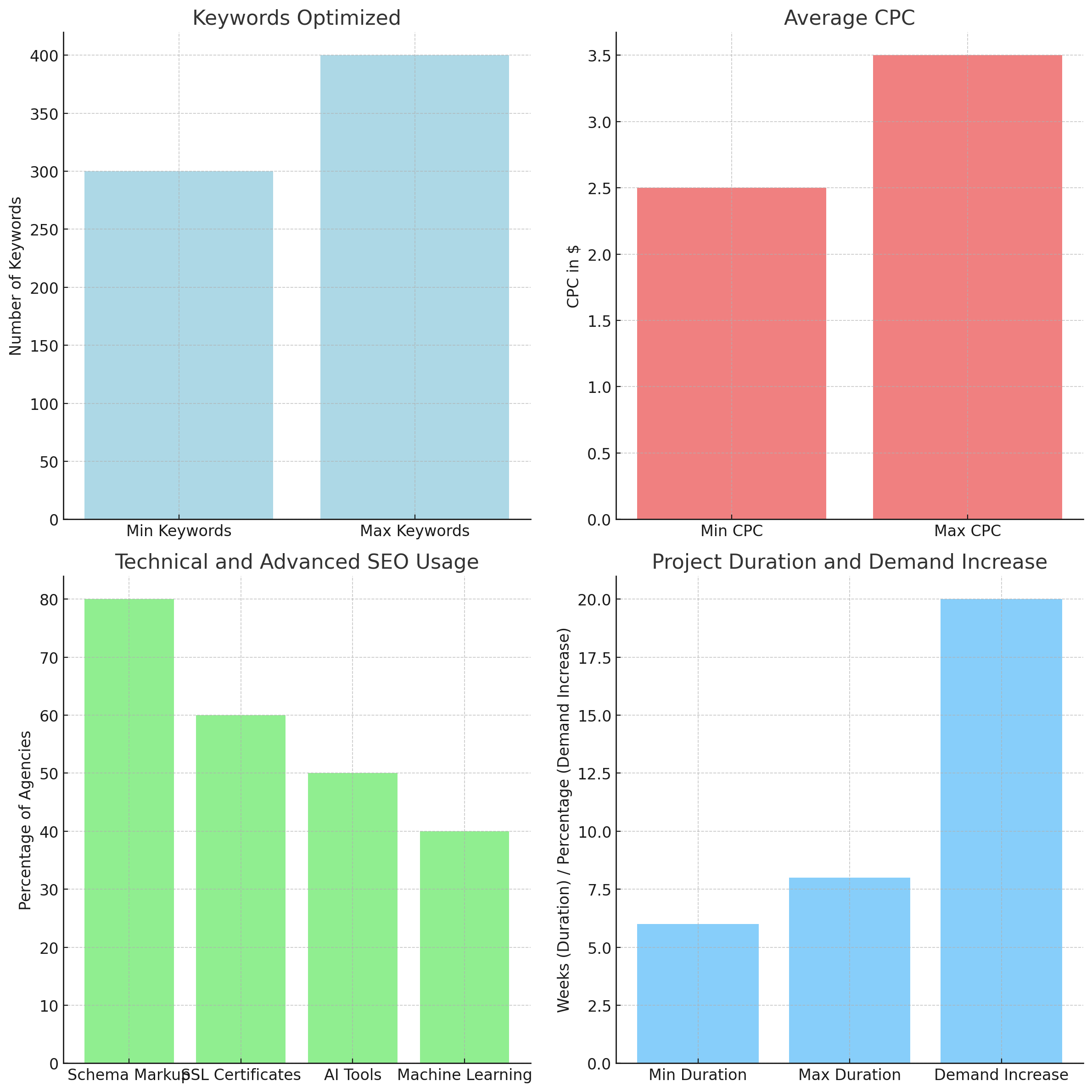

While agencies track hundreds of keywords for coverage, the strategy has shifted from exact-match phrases to Entity SEO. Search engines now prioritize the meaning behind the words. For example, distinguishing “Mint” (the financial platform) from the herb requires semantic context. Success in 2026 requires optimizing for concepts and answers (AIO – Artificial Intelligence Optimization) rather than just keyword density.

High CPC & Paid Synergy

Fintech remains one of the most expensive advertising verticals. Current data shows top-of-page bids for “SEO Fintech” keywords reaching nearly £30 ($38) per click. Because paid acquisition is costly, a robust SEO strategy is essential to lower the overall Customer Acquisition Cost (CAC). We recommend a hybrid approach: use SEO for long-term traffic and highly targeted ads for immediate conversion.

Technical SEO & E-E-A-T

In 2026, basic SSL is the bare minimum. Fintech SEO will focus on Core Web Vitals and E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness). Given the sensitive nature of financial data (YMYL – Your Money Your Life), successful campaigns must prioritize rigid site architecture, fast rendering, and demonstratable author expertise.

AI and Machine Learning

AI adoption is now standard. We expect over 90% of agencies to utilize AI for data analysis and keyword clustering. However, the trend for 2026 is Human-in-the-Loop (HITL) content creation—using machine learning to identify opportunities, but relying on human experts to ensure the content meets strict financial compliance standards.

Project Lifecycle

A comprehensive SEO foundation—including technical auditing and strategy implementation—typically spans 6 – 8 weeks. However, Fintech SEO is an ongoing ecosystem. To compete in this sector, brands must commit to a continuous strategy of content velocity and backlink acquisition.

Demand Increase

As the sector matures, the reliance on organic traffic is skyrocketing. We project a steady 20% year-over-year increase in demand for specialized SEO services in 2026 as companies move away from pure reliance on paid media.

Explore detailed statistics and future predictions at SEO for Financial Advisors.

Best Practices for Fintech SEO

- Entity & Keyword Integration

- Conduct research based on user intent and financial entities.

- Strategically integrate concepts to answer specific user financial queries.

- Technical Trust Signals

- Implement advanced schema markup to help Google understand financial products.

- Ensure bank-grade security protocols to boost E-E-A-T scores.

- Leveraging AI with Oversight

- Use AI-powered tools for clustering and gap analysis.

- Employ human financial experts for content verification and compliance.

- Effective Project Management

- Plan the initial audit and setup for 6-8 weeks.

- Establish a roadmap for ongoing link building and authority growth.

- Preparing for Market Demand

- Anticipate increased competition in Q1 and Q2 2026.

For additional best practices, visit Local SEO.

Conclusion

Staying ahead in the fintech SEO game means continuously optimizing and leveraging the latest semantic technologies. Comprehensive entity research, technical security enhancements, AI integration with human oversight, and market anticipation are crucial. For personalized SEO consultancy and comprehensive services, visit Calvin Crane.

By focusing on these strategies, fintech companies can effectively navigate the competitive landscape of 2026 and beyond.